2021 Worst accountants ever case notes – Case 4

This is the worst case we have ever come across. It includes betrayal by a trusted friend, who was also the accountant.

On a recommendation this client came to us, having been served with liquidation papers, resulting in not too distant High Court action brought on by Inland Revenue.

The client is a self-professed “tradie”, not sharp in business or tax matters. He was at a loss to understand how he owed over $400k in tax and penalties.

His old friend was his “accountant”. Trouble was he was neither a decent human being nor an accountant, but a rat bag. Tax work was done and filed via very occasional conversations only. My client saw no work, no return forms or otherwise. He was constantly reassured everything was fine.

On hand over the “accountant” sent in 3 annual accounts that he had prepared. He advised he had just had open heart surgery and could not assist further. The magnitude of the problem was noted immediately. The balance sheet was out of balance for each year. For the last year presented, it was out of balance by almost $30000.00!.

The former “accountant” created wild journal entries, miscoded transactions, declared over $100k of contract income as shareholders contribution, claimed for 2 vans purchased when there were no vans purchased, coded a wide range of spending to staff welfare (including his own accounting fees!), claimed rent and bond for the owners rented house for GST. You name it, he did it.

We could not attend to the accounts due to errors. We reworked the accounts going back to 01 April 2016. Had we not done so we would have accounts out of balance.

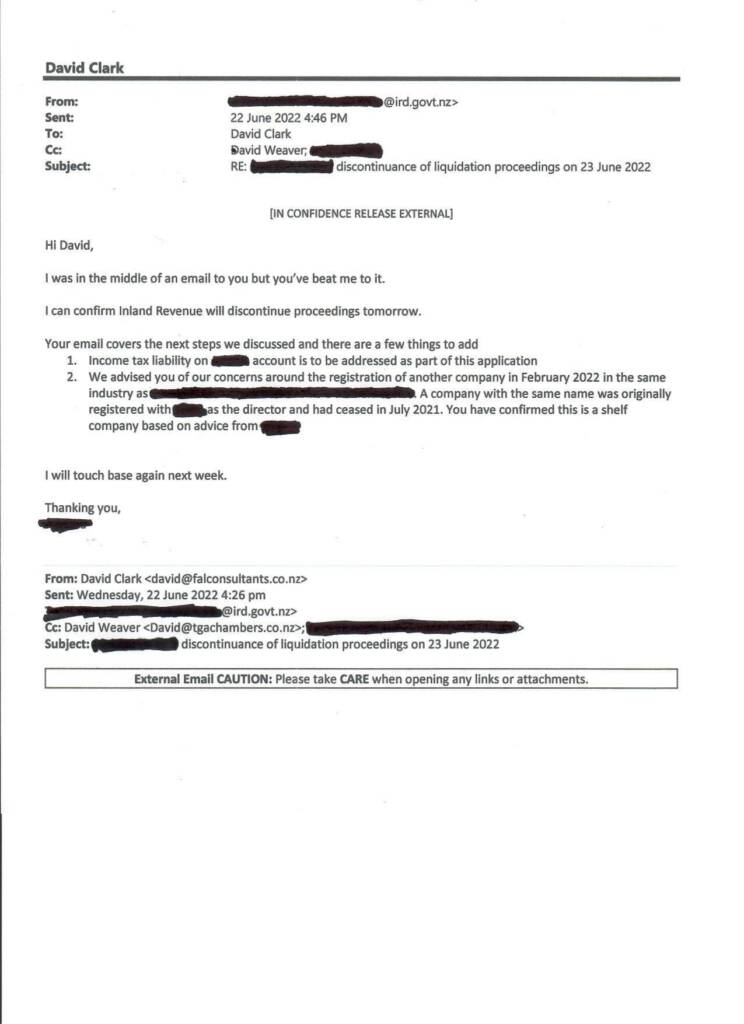

Our immediate action was to contact Inland Revenue and seek an adjournment back in June 2021. This was successful. We progressively sought adjournments for the following year until 23 June 2022. We recoded over 9500 transactions to get it all right. Inland Revenue was advised every step of the way and provided the time needed.

We believe this was the longest running Liquidation adjournment ever.

This was a huge case and each court fixture required new submissions. At stake was a man, his livelihood, his family, his employees, his business. His future.

When we engage in these actions, we have to work with Inland Revenue, and we fought so hard to show justice needed to be done in this astonishing case. Had it not been for the willingness for Inland Revenue to sort this out, my client would be “toast”. That, and our argument was beyond reproach. This took over a year to deal with and we are successfully working through our payment plan. We continue to provide support for this client with accounting and many other needs.