Cheap is not necessarily cheap, or good – Case 5

On a recommendation this client came to us with quite a few arrears of GST and tax.

The former accountant was part of a chain of “accountants”. My client is a real estate agent and somehow a years’ worth of GST had been filed as NIL. My client is at a loss as to how that happened, and the former accountant in Botany AKL had no idea either, although he was tasked with filing GST and tax.

We set the client up on a discounted MYOB software plan and got to work. The former accountants’ records were minimal, even for tax returns that were filed. Let’s put it this way: on a scale of 1 to 10,1 the lowest data and 10 the most data, this is a 2. The accounts and tax return were almost non-existent.

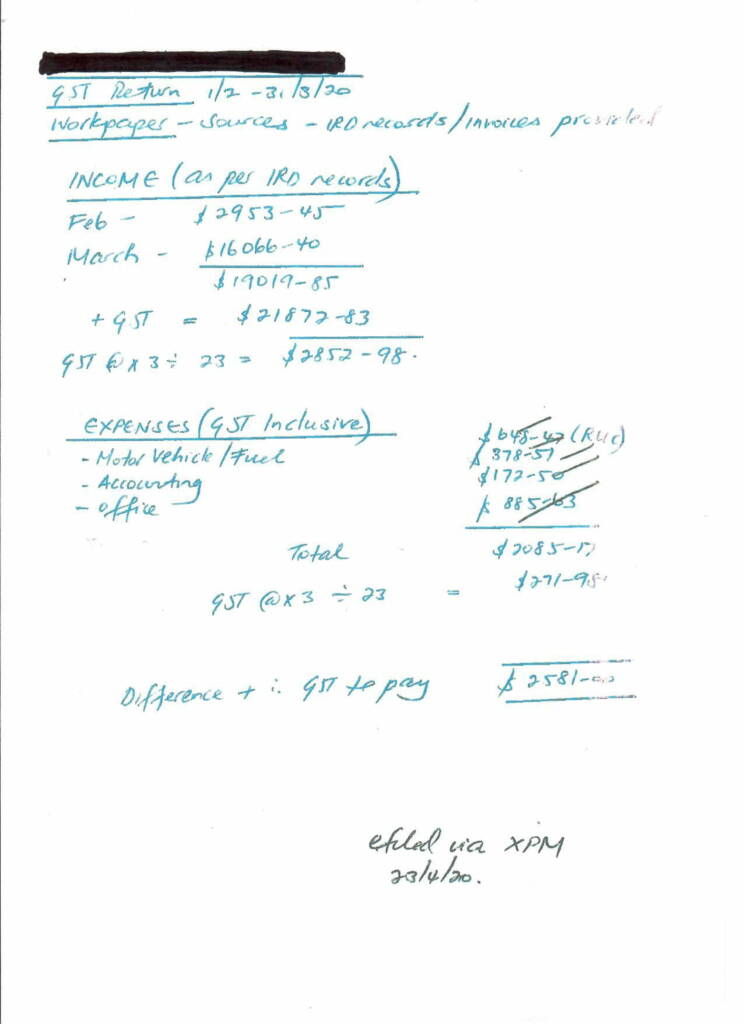

From the records that were handed over from the former accountant, I was shocked to see the GST workings schedule. This is not incorrect, but the client was paying $172.50 per GST return for a handwritten schedule!

This is a lot of money for amateur work. Check out the workings document.